The Ultimate Guide to Fleet Risk Management

Fleet managers are constantly looking for ways to minimize fleet risk, streamline operations, and improve their overall risk management plan. To reduce fleet risk, managers need a robust strategy that addresses core safety and compliance issues that threaten a company's ability to manage risk.

This fleet risk management guide covers the steps involved in developing a comprehensive fleet risk management strategy. It will also educate managers on how to lower fleet risks through improved driver training, vehicle performance, and automation best practices.

Benefits of Fleet Risk Management

Fleet risk management is an essential aspect of building a profitable and well-respected service company. Businesses that understand the importance of fleet risk management keep their drivers and vehicles safe and secure and mitigate costly losses and compliance issues.

Companies with a fleet risk management strategy cover their bases so they can focus on serving their customers and delivering higher value. Below are the benefits of fleet risk management.

1. Increase Driver Safety

The most immediate benefit of a fleet risk strategy is that it drastically improves driver safety. According to the Insurance Institute for Highway Safety (IIHS), there were more than 33,000 fatal motor vehicle accidents in the United States in 2019. With multiple drivers on the road for a minimum of eight hours a day, the odds of incidents increase exponentially for businesses. Fleet managers need to manage risk in the smartest and most effective ways to prevent tragic and costly driver incidents.

Fleet risk management best practices improve driver safety by:

- Ensuring managers hire the best and most qualified drivers

- Training drivers in the latest driver safety techniques

- Conducting ongoing driver evaluations

- Providing drivers with the tools they need to uphold safe practices

Managers wondering how to minimize fleet risk should start by devising a risk-management strategy that first and foremost addresses driver safety.

2. Mitigate Liability

Roughly $463 billion is spent every year in corporate litigation when companies are liable for motor vehicle accidents involving their employees or the general public. The litigation of these cases is costly and time-consuming, can be disruptive to company morale, and can harm corporate images. Both the direct and indirect costs can affect companies for months or years following a major incident due to lost revenue and the overall impact on profit margins.

Reducing risks to your fleet also mitigates the risk of liability involving fleet-related incidents. By implementing a compreheive strategy, fleet managers can lower the chances of accidents that incur liability on the company's part.

3. Improve Vehicle Maintenance

Maintaining a high-quality, well-serviced fleet is a proactive way to mitigate risk. Without a risk management strategy that identifies repair or replacement issues ahead of time, management teams are forced to continually react to breakdowns and address them as they arise. Preventive and predictive maintenance saves expensive and avoidable issues, as well as associated downtime.

Improperly maintained vehicles are also unsafe. Having a preventive maintenance strategy helps accomplish the priority of driver safety. Businesses that have a vehicle maintenance program in their fleet risk strategy benefit from a greater return on their investment, too. Properly maintained vehicles last longer, providing your team with extended service life.

4. Ensure Compliance

Companies that rely on their fleet to be fully operational at all times cannot risk productivity being stalled due to compliance infractions. But with continually expanding regulatory requirements, it can be challenging for fleet managers to keep up with compliance, let alone maintain it.

A risk management strategy gives fleet managers a clear plan for addressing compliance issues and ensuring they meet all requirements. An effective fleet risk management strategy will offer the benefit of automated tracking and filing, which frees up time for managers who used to be swamped by paperwork. A comprehensive fleet risk strategy will alleviate compliance headaches and leave managers feeling confident in their vehicles and drivers.

How to Develop a Fleet Risk Management Strategy

Fleet managers may understand why fleet risk management is essential, but they may not be sure how to manage fleet risk. To reap fleet risk management's financial and operational benefits, managers need a comprehensive fleet risk strategy.

As with all strategies, managers should start with their goals. Once fleet risk management objectives are in place, it's important to identify the tools and resources needed to achieve those goals. Finally, managers should conduct ongoing reviews of their fleet management systems and update their practices to achieve continuous improvement.

Below are four tips on how to reduce fleet risk with a comprehensive strategy.

1. Define Key Risk Areas

There is no one-size-fits-all approach to developing a fleet risk management strategy. Different industries have their own compliance requirements, vehicle types, and varying levels of risk. Additionally, depending on the size of the business, you may need to dedicate more resources to fleet risk management. However, despite the wide variety of businesses requiring fleet management, there are still fundamental aspects every business needs to address for better fleet safety and compliance.

To develop a robust fleet risk strategy, managers need to identify the core aspects requiring risk management. All fleet risk management strategies need to address these pillars of safety and compliance:

- Drivers: Safety and training

- Vehicles: Maintenance and inspections

- Operations: Driver scheduling and route planning

- Management: Documenting processes and setting benchmarks

By dividing your strategy into these four segments, your management team can ensure they neglect no aspect of risk management.

2. Adopt Risk Management Tools

In any area of business, we're only as effective as our tools. By investing in the right technology, fleet managers can drastically improve their operations. Fleet risk management software automates otherwise time-consuming processes, like scheduling, route planning, and report filing. Today's fleet risk management technology also plans preventive maintenance and monitors driver behavior for improved safety.

When developing a fleet risk management strategy, consider adopting these essential safety, maintenance, and compliance tools:

- GPS Tracking: Following vehicle activity to ensure compliance

- Telematics: Monitoring driver behavior for unsafe practices

- Fleet Management Software: Integrating all data and performing detailed analyses of operations

Adopting fleet risk management technology makes businesses more efficient, productive, and profitable.

3. Perform Regular Fleet Risk Reviews

Avoid viewing fleet risk management as a set-it-and-forget process. Business managers need to revisit their strategy and practices on an ongoing basis. Whether you've recently had a workplace incident or you're expanding your fleet, there are always opportunities to reflect and evaluate how your current risk management efforts are performing.

Fleet managers should regularly review potentially risky activities, such as patterns of poor driver behavior or failing to address vehicle maintenance issues quickly. To ensure regular reviews are getting done, management teams can designate one team member to be responsible for the ongoing review process and identifying areas of improvement.

4. Update Fleet Risk Practices

Business managers wondering how to reduce risks to fleets need to track fleet performance and activities and use that data to inform how to improve their strategy. With the information gleaned from ongoing reviews and monitoring of fleet risk practices, companies can identify meaningful ways to enhance practices.

Guided by technology and data, fleet risk managers will gain deeper insight into the exact practices they need to revise and eliminate to bring the fleet into improved compliance. An effective fleet risk management strategy is one operating on continual feedback for greater success and profitability.

Fleet Risk Management Best Practices

Properly managing a fleet of vehicles is about identifying and reducing risky activity to prevent unnecessary costs and lost productivity. To achieve competent fleet risk management, it's critical to implement industry-standard best practices that keep your business competitive while protecting drivers, the community, and your bottom line.

Below are some of the best practices in fleet risk management for managers to be aware of.

1. Implement a Hiring Policy

Ensuring driver safety is one of the pillars of an effective fleet management strategy. Keeping drivers safe on the road starts with hiring the most qualified ones for the job. Fleet managers should develop a robust driver screening program. Hiring managers should have a thorough understanding of any applicable state and federal requirements regarding driver hiring and develop their hiring policy accordingly.

For example, a driver hiring program should assess the following characteristics of each candidate:

- Experience level and prior training and certification

- Driving record and incident history

- Attitude toward safety

- Health and medical evaluation

Businesses subject to DOT regulations must maintain a thorough profile for each driver that can verify the above information.

2. Provide Driver Training

Once you've hired qualified drivers, the next step is to ensure you train them and offer ongoing skills development. Training and experience can mean the difference between a close call and a fatal accident.

Managers wondering how to manage risks to fleets can make no better investment than in their driver training program. Excellent driving training programs directly impact fleet costs and generate indirect benefits, like improving the company's reputation among customers and employees.

An effective driver training program should help drivers develop their skills and improve their commitment to safety.

3. Know Applicable Regulations

Fleet managers need to stay updated with evolving and expanding fleet regulations and insurance requirements. Without knowing which rules apply to your business, you could be taking unnecessary risks that open you up to costly and disruptive legal processes.

Many gray areas can cause confusion regarding whether specific regulations are applicable. Even if you don't think DOT rules apply to your business, you may still be subject to them under certain circumstances. It's essential to invest in legal expertise that will help you understand which local, state, and federal rules apply to your particular business.

4. Prioritize Preventive Maintenance

Preventive maintenance is the practice of scheduling routine servicing of fleet vehicles to prevent sudden breakdowns and disruption in vehicle availability. Companies that adhere to a preventive maintenance schedule can increase the lifespan of their vehicles and keep their overall fleet costs much lower. Vehicle maintenance also helps companies achieve safety and compliance goals.

Some essential preventive maintenance activities include:

- Regular vehicle inspections

- Testing and cleaning

- Oil and fluid changes

- Repairs and adjustments

- Parts replacement

Preventive maintenance schedules are based on vehicle class, hours of operation, or mileage. By scheduling preventive maintenance activities based on these milestones, fleet managers can accommodate out-of-service vehicles, making others available in a rotation.

5. Go Digital

Before today's technology, companies kept their fleet risk management records by pen and paper and, eventually, by spreadsheet. While those systems might be simple to use, they cannot provide the level of insight and analysis digital systems can. Digital tools are also more efficient, saving managers countless hours they can use to improve operations and training programs.

Today's digital systems automate and streamline many daily processes drivers and managers undertake, from vehicle maintenance to driver-vehicle inspection reporting. Robust software systems also identify areas for improvement so managers can further refine their fleet risk management strategy.

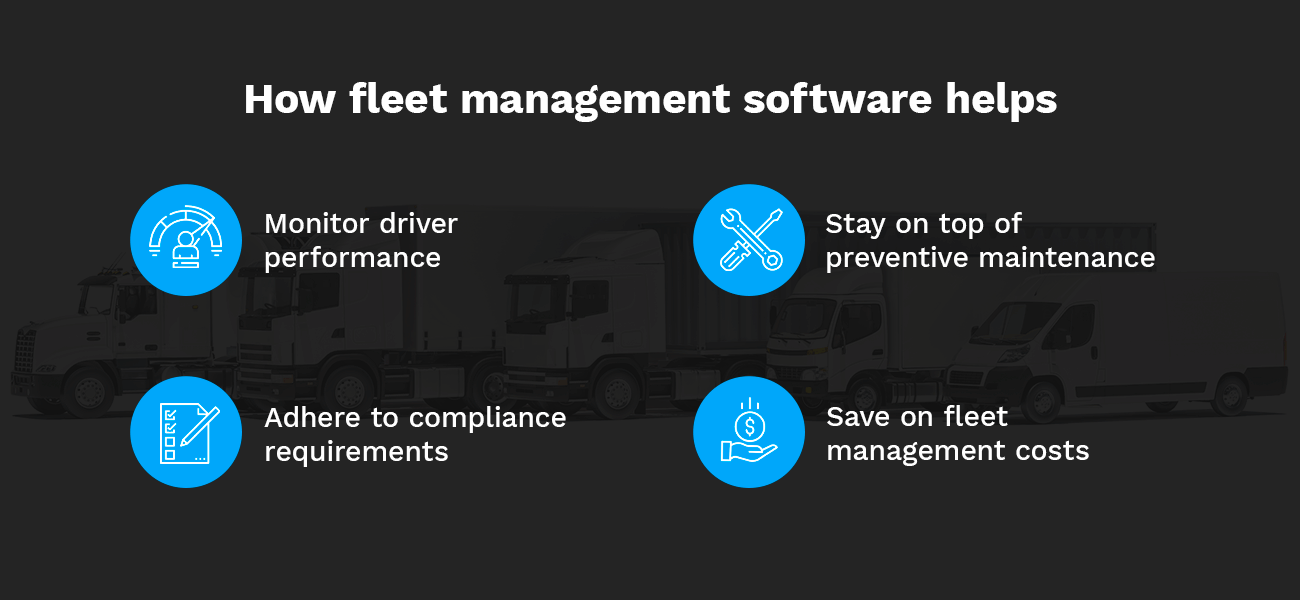

How Fleet Management Software Helps

No fleet risk management strategy is complete without the help of professional fleet management software. Fleet managers now have access to intelligent and detailed insight into driver performance, vehicle maintenance, asset tracking, compliance ratings, and more.

Here are some of the ways fleet management software helps businesses mitigate fleet risks.

1. Monitor Driver Performance

Fleet management software has integrated driver behavior monitoring, allowing managers to evaluate driver safety levels. Managers can receive alerts about unsafe driving behavior as it occurs, providing opportunities for additional training or other corrective action.

Intelligent fleet management software can also identify behavior patterns and overall habits. Driver analytics are key because they can indicate the types of driving scenarios that are more likely to elicit unsafe driving behavior, which managers can account for and mitigate moving forward.

2. Stay on Top of Preventive Maintenance

Fleet risk management software is equipped with vehicle analytics, providing insight into vehicle performance and maintenance issues. Using vehicle analytics, managers can adhere to an intelligent preventive maintenance schedule proactive in addressing critical issues before they arise.

By gaining insight into maintenance issues, managers can quickly respond to concerns and schedule maintenance with limited interruption in vehicle availability. This ability streamlines repairs and servicing and produces adequate maintenance records to help keep your CSA scores low.

3. Adhere to Compliance Requirements

Fleet management software helps you streamline compliance activities like driver reporting, making staying compliant easier. Additionally, fleet management software can change to fit the needs of the business, with solutions specifically for industries like:

- Oil, gas, and mining

- Transportation and logistics

- Moving and storage

- Public transit

- Heavy equipment and construction

Each industry has its own regulatory compliance requirements. Having software tailored to your industry helps ensure your fleet management program adheres to the compliance rules that matter most to your business.

4. Save on Fleet Management Costs

Implementing an effective fleet risk management strategy doesn't just improve safety — it lowers overall costs, too. Fleet management software helps your organization manage your fleet more efficiently. From reduced maintenance costs to lower fuel consumption to decreased labor expenses, fleet management software enables you to keep your overhead in check.

With the insight managers gain into their fleet performance, they're able to make operational adjustments that save them money. Whether you need to optimize your route planning or improve driver behavior, fleet management software shows you where you can save.

Choose Rand McNally Fleet Solutions

By following this guide to fleet risk management, fleet managers can adopt an efficient and cost-effective strategy for mitigating fleet risk and reducing unnecessary financial losses. A fleet risk management strategy keeps drivers safe, extends vehicle service life, and ensures companies stay compliant.

Now that you know how to minimize risks to your fleet, the next step is partnering with the right provider of fleet management software. Rand McNally Fleet provides comprehensive fleet management solutions that reduce overhead costs, improve safety, and provide you with detailed insight into operational improvement opportunities. Contact us today to request pricing or schedule a demo.

Contact Rand McNally

Request Pricing for Fleet Solutions

We're looking forward to talking with you. Please fill out the form to get started.

Or call us:

+1 (800) 789-6277 (Fleet management, ELD, Asset tracking, Navigation)

+1 (800) 234-4069 x2 (MileMaker/IntelliRoute)

If you are an existing customer and need assistance, please contact your Client Success rep or email fleetsupport@randmcnally.com.

This form is for business-to-business transactions only. It is not for personal consumer use.